What Is Not Step Of Money Laundering

Money laundering is the illegal process of converting money earned from illegal activities into clean money that is money that can be freely used in legitimate business operations and does not have to be concealed from the authorities. The first step is called placement.

Understanding Money Laundering European Institute Of Management And Finance

And b it places the money into the legitimate financial system.

What is not step of money laundering. The second step is laundering. There are many ways of money laundering which are explained in the articles linked at the end of this post. Investing in real estate.

Generally this stage serves two purposes. Investing in other legitimate business interests. What is money laundering.

What is money laundering. Dividing huge amounts of money smuggling funds abroad or other ones. Concealing or disguising the true nature source location disposition movement or ownership of the property.

Asking the client for information is the first step in responding to a warning sign. After getting hold of illegally acquired funds through theft bribery and corruption financial criminals move the cash from its source. What are the 3 steps of money laundering.

Process of Money Laundering. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate financial system. Its the answers your client gives and more importantly the way they give them which will help you to assess whether your warning sign gives rise to a suspicion of money laundering or not.

Money laundering is a technique used by criminalsfrom mobsters drug traffickers terrorists to corrupt politiciansin order to cover their financial tracks after illegally obtaining money. It includes the tools which criminals. It suggests finding ways of cash laundering.

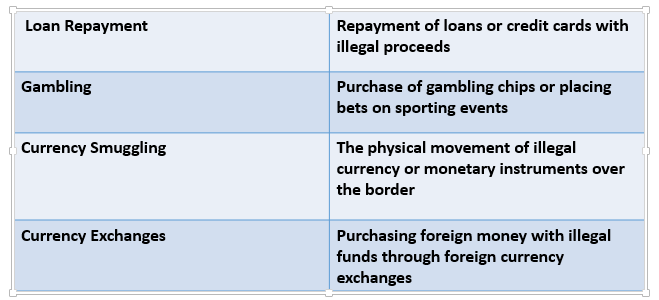

Some common methods of laundering are. Responding to warning signs. Its well-known that money laundering can often involve foreign banks and legitimate businessesso how do banks actively prevent money laundering from happening.

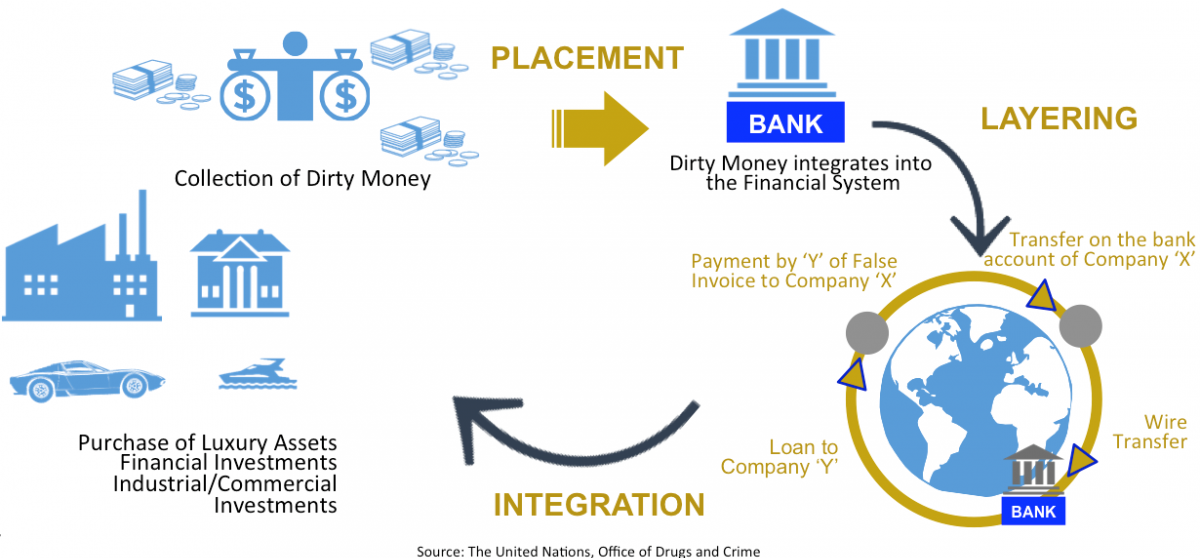

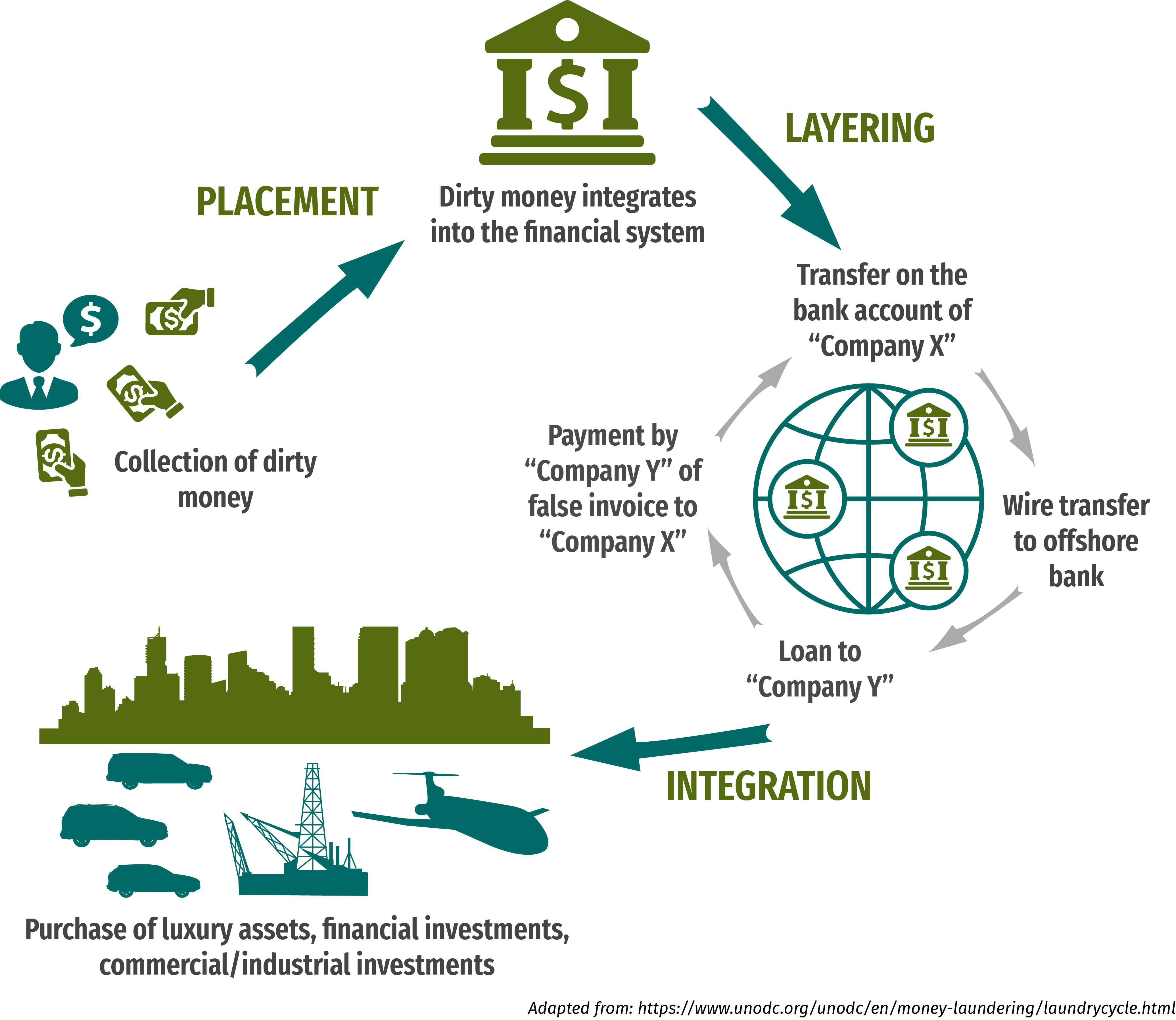

A it relieves the criminal of holding and guarding large amounts of bulky of cash. The first stage of money laundering is known as placement whereby dirty money is placed into the legal financial systems. Money Laundering is the process of changing the colors of the money.

Reselling high-value goods such as artwork or any type of stored-value product such as jewelry or prepaid cards. The money laundering process is divided into 3 segments. Money laundering offences are committed where a person knows or believes or is reckless as to whether or not that the property represents the proceeds of criminal conduct and the person is involved in.

The institution may be anything from a brokerage house or bank to a casino or insurance company. Global markets consider money laundering a significant white collar crime. This is the most vulnerable stage of money laundering as criminals are.

This represents the most dangerous step for the criminal as the government. The scope of money laundering proceeds is estimated in the billions to trillions of dollars each year. Criminals make the proceeds of crime appear to be legitimate in order to get away with their crime without raising suspicion.

It is during the placement stage that money launderers are the most vulnerable to being caught. At the placement stage for example the funds are usually processed relatively close to the under-lying activity. Typically a money launder will cover up the funds origin by passing it through various banks and legitimate businesses.

Money laundering activity may also be concentrated geographically according to the stage the laundered funds have reached. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. Until they do this they are unable to use the money without authorities tracing it back to their crime.

Money Laundering is an act of act of disguising the illegal source of income. Money laundering layering is the process of covering the illegal channels so it would not fall under detection. And at the same time hiding its source.

Money laundering is the illegal process of covering up the origins of money acquired through criminal activity. The Money Laundering Process. Its very easy to define but involves multiple techniques.

This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions. The Placement Stage Filtering. Money launders use a wide range of methods to make illegally sourced money appear as clean.

Placement is the first step of money laundering which is the process of moving the money into the legitimate source via financial institutions casinos financial instruments etc. There are 3 stages of money laundering. This is where the criminal money is washed and disguised by being placed into a legitimate financial system such as in offshore accounts.

Placement can take place via cash deposit wire transfer check money order or other methods. Money laundering involves the use of processes to disguise an original source of funds or assets that are generated through criminal activities such as drug trafficking fraud smuggling corruption or extortion. Because the objective of money laundering is to get the illegal funds back to the individual who generated them launderers usually prefer to move funds through stable financial systems.

This is the act of moving the ill-gotten funds into a financial institution. These are called methods of laundering. It involves three stages.

However regardless of the methods. Basically different money launderers gain money from illegal sources and try to convert it into legitimate by using different ways. Money laundering is the term used to describe the act of taking illegal money from source A and making it look like it came from source B a legitimate legal source.

Setting up or using shell companies to move illegal funds and obscure ultimate beneficial ownership and assets. The first one is placement.

Process Of Money Laundering Placement Layering Integration

Anti Money Laundering Overview Process And History

Understanding Money Laundering European Institute Of Management And Finance

Network Analytics And The Fight Against Money Laundering Mckinsey Company

What Is Money Laundering Three Methods Or Stages In Money Laundering

What Are The Three Stages Of Money Laundering

Aml Screening How It Might Infiltrate Your Business

What Is Money Laundering Three Methods Or Stages In Money Laundering

Three Stages Of Money Laundering Download Scientific Diagram

Process Of Money Laundering Placement Layering Integration

Cryptocurrency Money Laundering Explained Bitquery

Money Laundering Terrorist Financing Are You Aware Anti Money Laundering Compliance Unit

Understanding The Risks Of Money Laundering In Sri Lanka Daily Ft

How Money Laundering Works Howstuffworks

Three Stages Of Money Laundering Download Scientific Diagram

Tnrc Introductory Overview Why Is Money Laundering A Critical Issue In Natural Resource Corruption Pages Wwf

Post a Comment for "What Is Not Step Of Money Laundering"