Money Laundering In Insurance Sector With Suitable Examples

Insurance companies that issue or underwrite covered products that may pose a higher risk of money laundering must comply with Bank Secrecy Actanti-money laundering BSAAML program requirements. For example a life insurance policy that.

/GettyImages-183427329-7daf2c51c7ad4af0b946413a2eefa947.jpg)

What Is The Main Business Model For Insurance Companies

In particular some money laundering schemes involve products and transaction types that exist in the banking and insurance sectors as well.

Money laundering in insurance sector with suitable examples. Examples of money laundering and suspicious transactions involving insurance This document contains examples of money laundering and suspicious transactions involving insurance. A covered product includes. Insurance products can be used to facilitate money laundering.

Money laundering is similar to washing clothesyou put in dirty clothes and after being washed the clothes are clean. Laundered funds can then be used without restriction. Like other jurisdictions insurance industry regulations in APAC are risk-based and entail a range of transaction monitoring requirements.

Using case studies and real-life examples the course explores how life insurance products can be used in money laundering activities and explain how the AML rules apply. Insurance regulations only apply to insurance companies excluding agents and brokers from the requirements. Non-life insurance A money launderer purchased marine property and casualty insurance for a phantom ocean-going vessel.

AS an illustration of money laundering using life-insurance products the first known case of money laundering using insurance was reported in the New York Times on December 6 2002. Using Insurance to Launder Money When people think of money laundering they might imagine criminals carrying bag loads of dirty money to a casino or a private bank in the Caribbean. Money laundering and terrorist financing indicatorsLife insurance companies brokers and agents.

Insurance fraud has a significant negative impact on the industry. Every major non-life insurance company in the Swedish market was affected by its activities The impact of insurance fraud Insurance Europe 2013. It was originally created as an appendix to the IAIS Guidance paper on anti-money laundering and combating the financing of terrorism October 2004 and is updated.

This course provides a thorough review of the anti-money laundering AML rules and guidelines as they pertain to insurance companies and insurance producers. The reasoning behind this is due to the fact that banks must report large or suspicious transactions to the IRS. Anti-money laundering AML was the number one cause of FINRA fines in 2016 2017 and 2018.

For example currency can be used to purchase one or more life insurance policies which may subsequently be quickly canceled by a policyholder also known as early surrender for a penalty. It is washed to make it look clean. As the number and value of enforcement actions increase worldwide knowledge around money laundering through securities product s is starting to e merge.

This guidance on suspicious transactions is applicable to life insurance companies brokers or agents that are subject to the Proceeds of Crime Money Laundering and Terrorist Financing Act PCMLTFA and associated Regulations. 2 Foreword The Bermuda Monetary Authority the Authority or BMA is committed to combatting money. For example investigators in Sweden identified a criminal network that arranged at least 214 staged traffic accidents.

Money laundering case examples. Insurance industry doubled from just over 4000 to just over 8000 from 2003 to 20065. Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and subsequently withdraw large amounts of cash with a relatively.

The insurance company refunds the money to the purchaser in the form of a check. Owing to the vital role played by the insurance sector in the economic growth of a country the purpose of this paper is to highlight the serious threat posed by money laundering activities in exploiting the insurance industry from the Malaysian perspective Provides a description of the risks posed by money laundering in the insurance sector along with some useful case examples. Money Laundering and Terrorism Financing Risks within the Insurance Sector 20 September 2018 Bermuda Monetary Authority Occasional Paper.

Illegal money is put through a cycle of transactions designed to hide the source of the funds and make them clean or legitimate. Money laundering in insurance sector with suitable examples. Like other jurisdictions insurance industry regulations in APAC are risk-based and entail a range of transaction monitoring requirements.

I n Singapore for example the Monetary Authority of Singapore MAS includes specific requirements for insurers in Notice 314 on the Prevention of Money Laundering and Countering the Financing of Terrorism. Unsurprising ly a nagging challenge for most firms is detecting and assessing the ir money laundering risks and designing. In Singapore for example the Monetary Authority of Singapore MAS includes specific requirements for insurers in Notice 314 on the Prevention of Money Laundering and Countering the Financing of Terrorism.

Some areas of vulnerability for example rogue employees are not peculiar to the securities industry and thus this study is of relevance to the wider financial services sector. What many people do not realise is that insurance products particu-larly life insurance provide a very attractive and simple means of laundering money.

What Is The Real Money Laundering Risk In Life Insurance High Risk Low Risk Or No Risk That Is The Question Acams Today

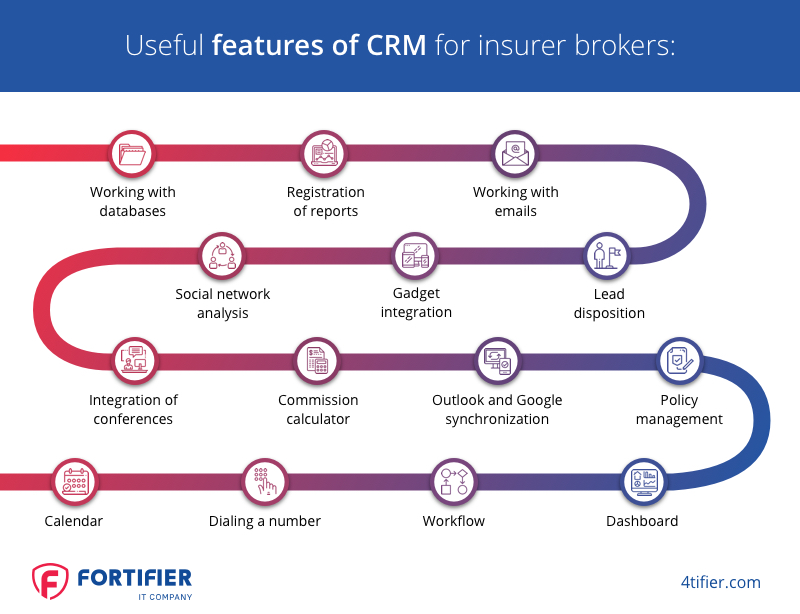

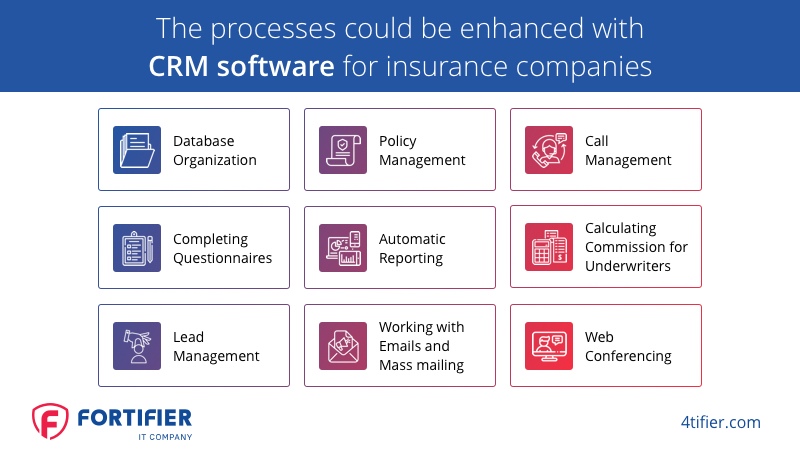

The Best Crm Software For Insurance Agents How To Choose A System For Your Company 4tifier Com

Why We Are Excited About Embedded Insurance In 2021 Albionvc

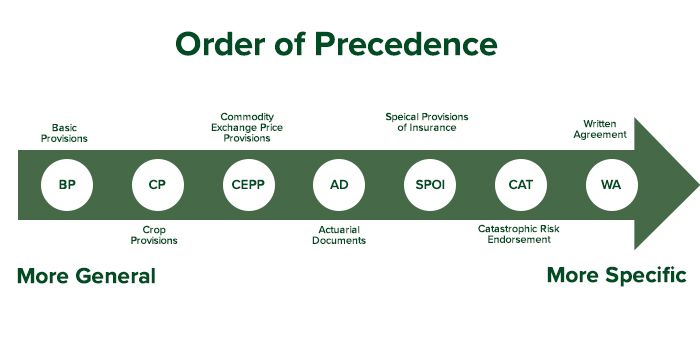

Basics Of Crop Insurance Proag

Predictive Analytics In Insurance Types Tools And The Future

Predictive Analytics In Insurance Types Tools And The Future

Https Www World Check Com Media D Content Pressarticle Reference Aisaninsurance 08 Pdf

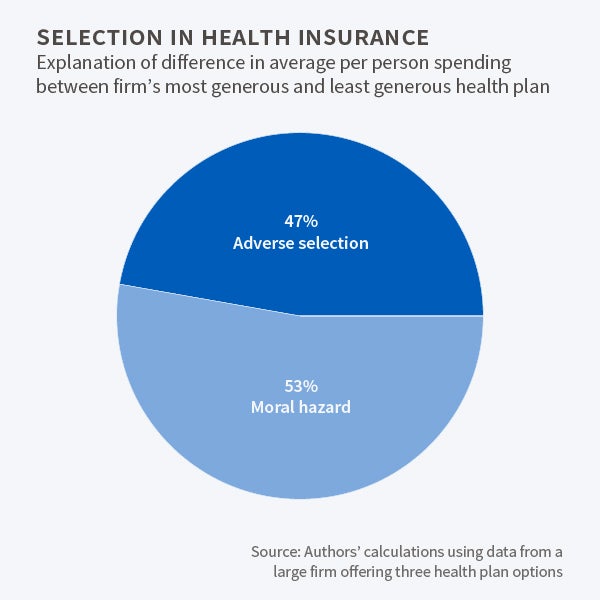

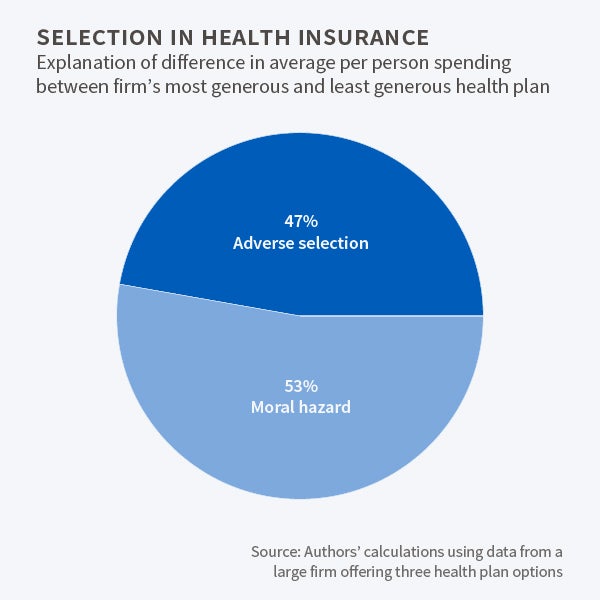

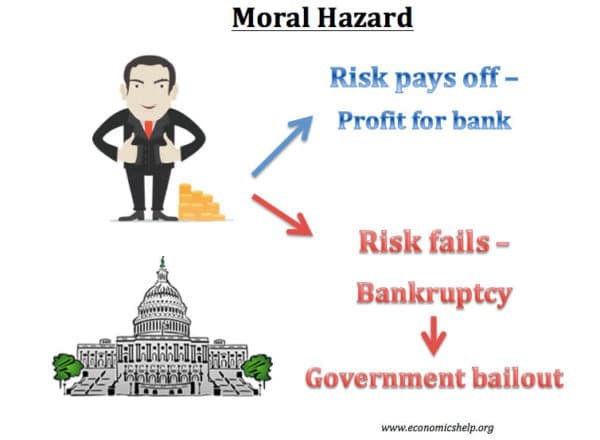

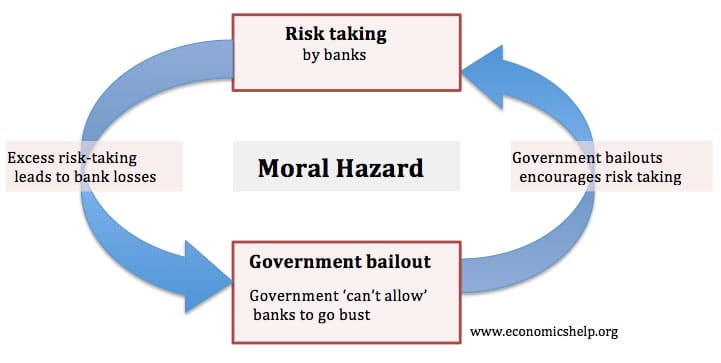

Moral Hazard And Adverse Selection In Health Insurance Nber

Basics Of Crop Insurance Proag

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Insurance Company Business Plan Template For 2021 Bplans

How Does Life Insurance Work Forbes Advisor

:max_bytes(150000):strip_icc()/insurance-3-5bfc2b44c9e77c005876f93a.jpg)

Examples Of Adverse Selection In The Insurance Industry

Why Insurers Must Get To Grips With Due Diligence And Financial Crime Arachnys

Here S A Good Example Of How Your Health Insurance Deductible Works Insurance Deductible Deduction How To Plan

The Best Crm Software For Insurance Agents How To Choose A System For Your Company 4tifier Com

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Post a Comment for "Money Laundering In Insurance Sector With Suitable Examples"